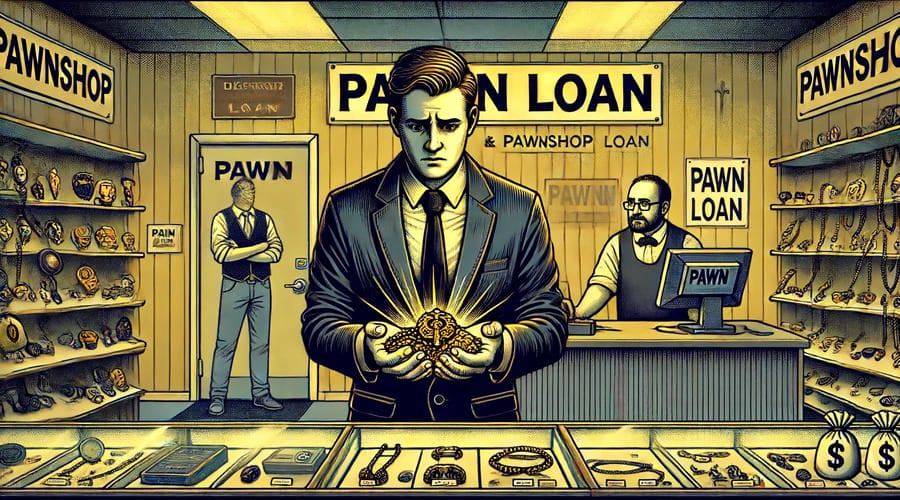

Pawnshop loans, usually thought of another financial resolution, have gained reputation because of their accessibility and quick funding capabilities. Unlike conventional loans that require extensive credit checks, pawnshop loans permit people to safe funds by leveraging their useful property, similar to jewelry, electronics, or collectibles. This article aims to discover the ins and outs of pawnshop loans, discussing their advantages, potential drawbacks, and practical methods for maximizing their benefits. Given the monetary landscape's unpredictability, understanding how pawnshop loans work can empower people to make informed decisions relating to their monetary health. For many, these loans characterize a lifeline during emergencies, whereas others may find them appropriate for short-term financial needs. With a proper understanding of the pawnshop mortgage course of, customers can navigate their options properly and probably rework a difficult financial state of affairs right into a manageable one.